Every tax season presents its own unique challenges, and we are providing leading-edge resources and education to help you provide solutions for your clients in the area of charitable donations, impact investing and how to leverage these in their tax planning strategy to reduce tax liabilities.

Download PDF

Professional Resources

Charitable Organizations

Organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, educational, or other specified purposes and that meet certain other requirements are tax exempt under Internal Revenue Code Section 501(c)(3).

Read More

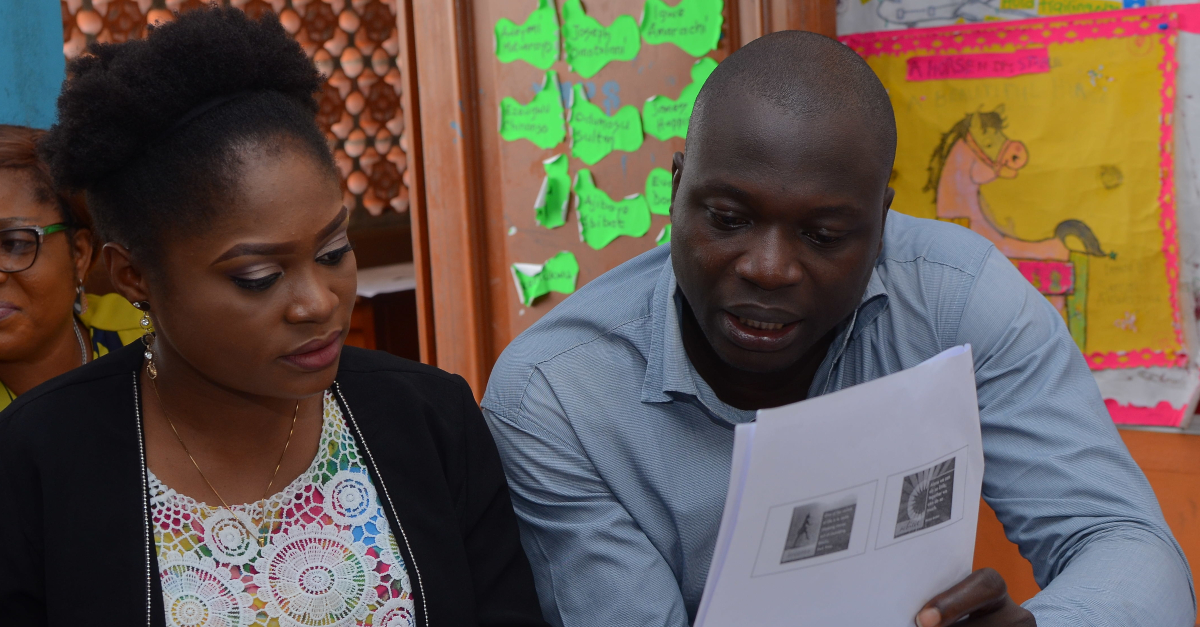

Guiding families in their philanthropic endeavors | podcast

Family office clients have complex planning issues. It’s helpful to collaborate with a team of advisors and not feel like you must have all the answers. It is often valuable to begin the engagement by having conversations about what matters most to the family and for their legacy.

Read More

How Nonprofit Accounting Differs from For-Profit

Understand the key differences between nonprofit and for-profit accounting, including unique financial reporting requirements, tax implications, and why accountants recommend specific approaches for each.

Read More

Nonprofit Accounting Best Practices

Discover essential accounting practices for nonprofit organizations, including fund accounting, donor restrictions, and financial reporting requirements that accountants recommend for compliance and transparency.

Read More

In-Kind Donation Accounting

Learn about proper accounting practices for in-kind donations, including valuation methods, documentation requirements, and compliance with accounting standards for charitable contributions.

Read More

Charitable Tax Strategies & Contributions

Explore advanced charitable tax strategies and contribution methods to maximize tax benefits while supporting charitable causes through proper planning and itemized deductions.

Read MoreForms and Instructions

Exempt Organizations Annual Reporting Requirements - Form 990

Learn about Form 990 Schedules A and B, facts and circumstances public support test requirements for tax-exempt organizations receiving more than 1/3 of their support from governmental sources.

Read More

80G Deduction: Donations to Charitable Institutions

Comprehensive guide to understanding Section 80G deductions for charitable donations, including eligibility criteria, qualifying institutions, and tax benefits for donors.

Read MoreDonor Resources

Charitable Donations

With the enactment of the 2017 Tax Cuts and Jobs Act (TCJA), Schedule A, Itemized Deductions, was modified to the detriment of many taxpayers.

Read More

Everything You Need To Know About Your Tax-Deductible Donation

A tax-deductible donation must meet certain criteria to qualify and count against your taxes. See if a donation is deductible and if it will lower your tax bill.

Read More

2023 tax rules and tips for easier, cost-effective charitable giving

It's during the holiday season that people in the U.S. typically make roughly one-third of their annual donations to charity, moved by both generosity and the December 31 deadline for securing tax deductions.

Read More

Your Charitable Deductions Tax Guide

With the recent 2023 IRS updates due to inflation as well as any personal changes (a new job, home, or medical expense), it’s a smart time to tune up your tax strategy and see how you can maximize your charitable contributions and continue making an impact on the causes and organizations you care about.

Read More